Protecting your core range in 2023

TRKR, IRI & Peperami, 2nd February 2023

As we leave the dark, dreary days of January 2023 behind us, and head into the dark, dreary days of February 2023 instead, this morning’s TRKR webinar on protecting the core range was a great example of the situation facing food & drink suppliers in the year ahead.

IRI - suppliers should prepare for volume decline

Dan Hunt of IRI Worldwide painted a fairly bleak outlook for us - don’t shoot the messenger though, he was only sharing the data…

UK Inflation will continue through 2023

Lower price goods are impacted more, making poor people poorer

Unit price is the key decision driver, rather than volume price. Another disadvantage to those shoppers on lower incomes

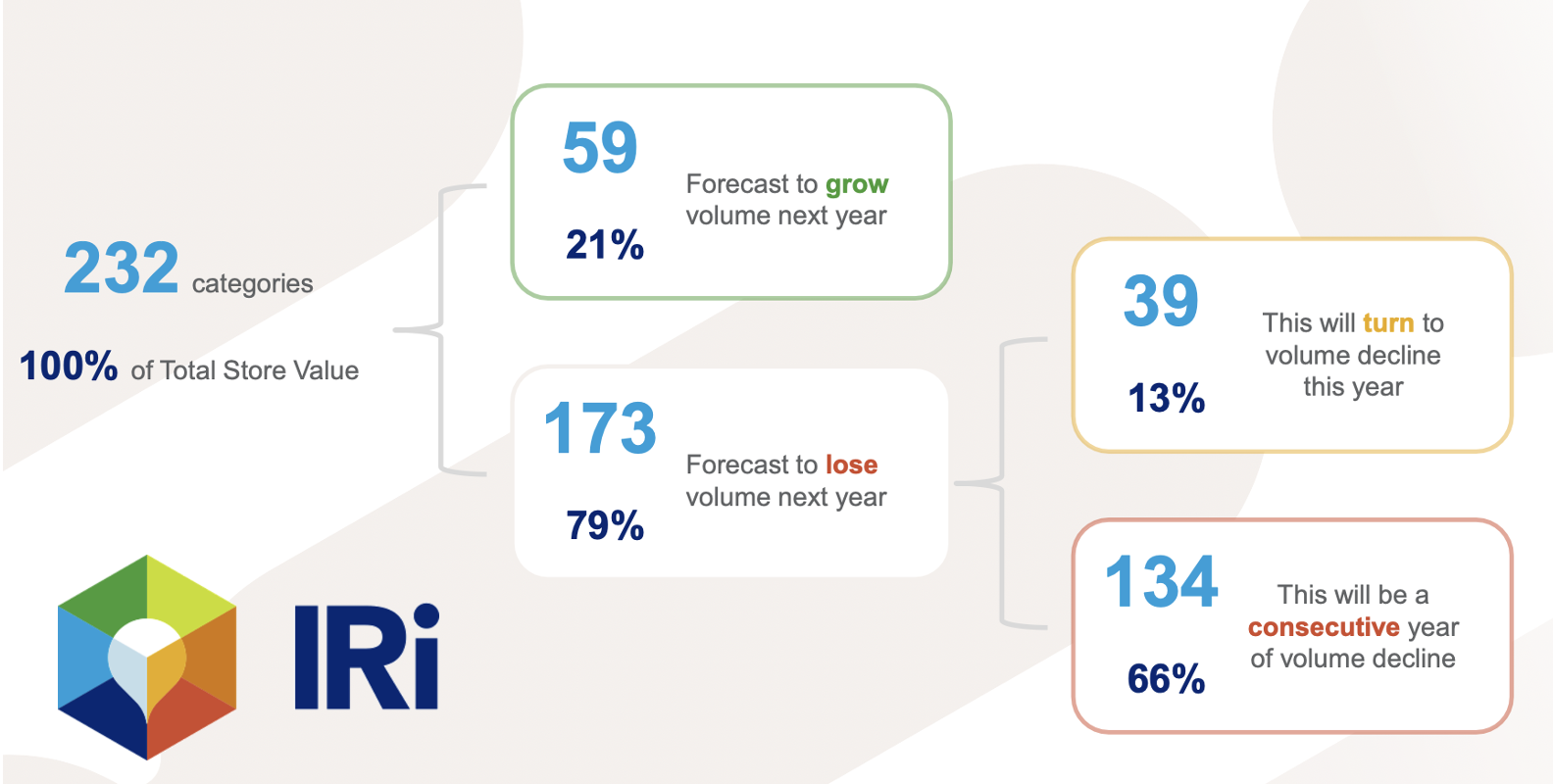

The combined effect is that volume decline is forecast for 80% of categories

Source - IRI 2023

However, on the plus side, Dan did have some important bits of advice…

Attribute priming…understand what part of your product proposition matters most to consumers, and call it out

Understanding Price Elasticities allows you to plan cost price increases strategically. An IRI client in the pet food category was able to generate +£1M in RSV (Retail Sales Volume) by understanding which format they could increase the price of (cans) and which they couldn’t (aluminium trays)

Peperami growth

On a happier note, Pav Chandra, ex-Head of Marketing for Peperami explained how the brand achieved double digit growth every year during his time there.

NPD played a part, but mostly they played to the brand’s core strengths alongside addressing any barriers. Over the piece, 75% of the brand growth came from the core, 25% from NPD.

One simple change was to attract the younger audience by calling out key features such as low calorie and protein packed. Attribute priming….or in TRKR speak, knowing your Value Proposition

TRKR view…

Evaluate and strengthen your core range

Are you getting the most out of existing products and core range?

Using the right blend of market data (IRI, Nielsen, Kantar), bespoke insight and shopper feedback, there may be ways to grow the Core that are easier (and more cost effective) than doing NPD.

Focus your efforts and resource on the products that are working for you, rather than those that aren’t, and make sure you understand what matters most to shoppers.

For more examples of we support Food & Drink suppliers with both strengthening their existing ranges and NPD, go to our homepage